Learn to detect fake financial experts on social media. Spot warning signs, verify credibility, and protect your money from online financial scams.

handles.org Newsroom Team

Written by

Dec 15, 2025

Quick Summary

Social media is rife with fake financial “gurus” promising quick profits. Learn how to spot red flags, verify credentials, cross-check advice, and protect your money. This guide also shows how to secure accounts, safeguard personal data, and use Handles’ AI tools to detect impersonators and stay safe online. For deeper insights and ongoing safety tips, explore more expert articles on our website.

Could the financial “guru” in your feed be a scammer?

Social media is filled with self-proclaimed money experts promising quick profits, secret investment strategies, and instant wealth. Every day, people lose savings to fake crypto schemes, fraudulent forex tips, and influencer-backed investment cons that look credible at first glance.

While some offer genuine guidance, many are scams designed to steal your trust, personal data, and hard-earned money. Knowing how to spot red flags and verify credibility is essential to protect yourself online.The line between education and exploitation on social platforms has never been thinner.

This Handles guide explains how to recognise social media financial scams, spot red flags early, verify legitimate sources, and protect yourself from online fraud.

Why listen to us?

We have helped remove more than 9,000 infringing Adidas accounts in the first phase of protection, safeguarding over 100 million followers and ranking among Meta’s top performers for eliminating counterfeit content. This hands-on work gives us a deep understanding of how financial scammers operate and how to stop them effectively.

The Rise of Financial Scams on Social Media

Gone are the days when financial advice was limited to just professional channels. Lately, anyone with a camera and confidence can pose as a financial expert and millions listen.

According to the Federal Reserve Bank of Philadelphia, social media is now a popular source of financial tips, especially among younger adults, even though most users admit they find it unreliable.

The risks are real. In the first half of 2023, more than half of all money lost to social media scams came from investment-related schemes. In the UK, TSB found that nearly one in three people had acted on financial advice they saw online, and over half of them lost money as a result.

Regulators are sounding alarms. The Financial Conduct Authority (FCA) has flagged the growing influence of “finfluencers” and found that among 18-29-year-olds, 62 % follow social media influencers, and 74 % of those say they trust their advice.

All of these show that people increasingly rely on flashy social posts rather than regulated advice. And fraudsters know this. They exploit the sudden moment of attention, masquerading as “money gurus,” promising fast returns and leveraging FOMO (fear of missing out) to convert followers into victims.

Red Flags of Fraudulent Financial Advice

Social media has become a hub for financial conversations, from saving hacks to investment “opportunities.” But alongside credible experts are individuals who exploit the trust of online users with deceptive advice and false promises. Recognizing these red flags early can protect your finances and peace of mind. Below are some signs you should watch out for

Unrealistic Promises

Be wary of anyone who guarantees “double your money,” “zero-risk investments,” or “instant profits.” This is because no legitimate financial advisor can promise returns without risk. Genuine investment opportunities are transparent about potential losses as well as gains.

Pressure Tactics

Phrases such as “This offer ends tonight” or “Message me privately to join” are designed to create unnecessary urgency. Sound financial decisions require time and research, not impulsive action. Anyone who discourages you from taking time to think is not acting in your best interest.

Lack of Transparency

A credible financial expert should have verifiable credentials and be registered with a recognized regulatory body such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. If you cannot find their name on official registers like register.fca.org.uk or sec.gov, take it as a serious warning sign.

Fabricated Proof and Testimonials

Many fraudulent accounts use fake screenshots or doctored testimonials to appear successful. Always be skeptical of “clients” who show extraordinary gains with little explanation or evidence of real activity.

Emotional Manipulation and Unverified Giveaways

Scammers often prey on greed and fear of missing out (FOMO), promising exclusive access to secret investment groups, free giveaways, or “insider” opportunities. These are often traps designed to capture your personal or financial details.

Actionable Steps: How to Distinguish Legitimate Experts from Scammers Targeting Online Users

Once you can spot the warning signs of fraudulent advice, the next step is verifying the credibility of the person or account offering it. Verification helps you separate legitimate experts from those seeking to exploit your trust.

Check Official Credentials

Real financial professionals and regulated advisors are registered with recognized authorities.

For example:

In the UK: Financial Conduct Authority (FCA)

In the US: Securities and Exchange Commission (SEC)

Search their name or firm on register.fca.org.uk or sec.gov. If they claim certification but do not appear in these registers, treat it as a serious red flag.

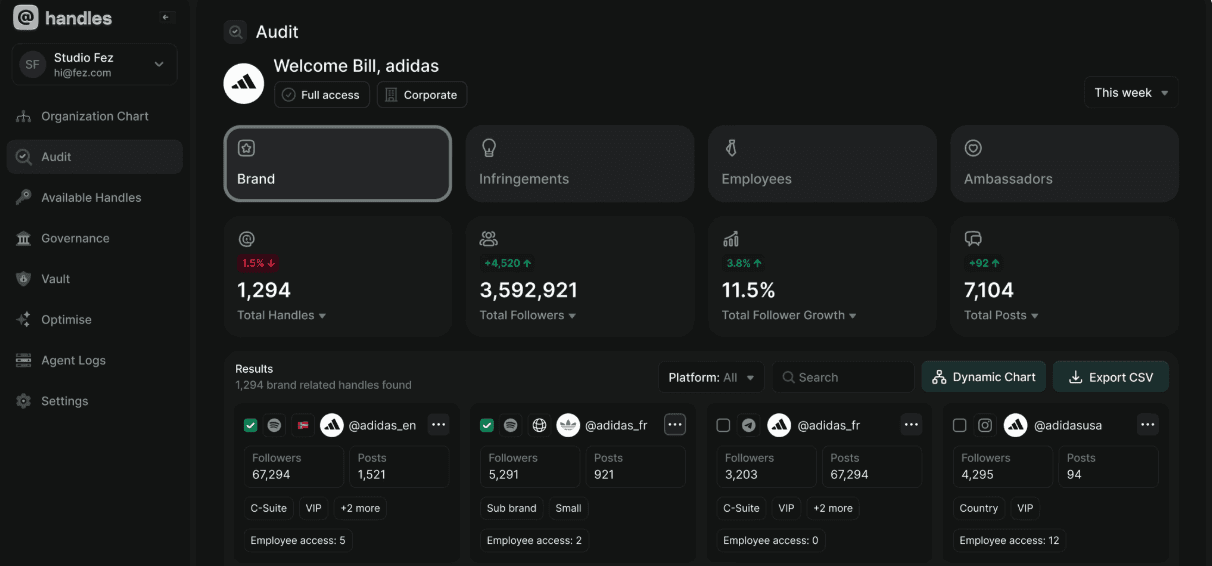

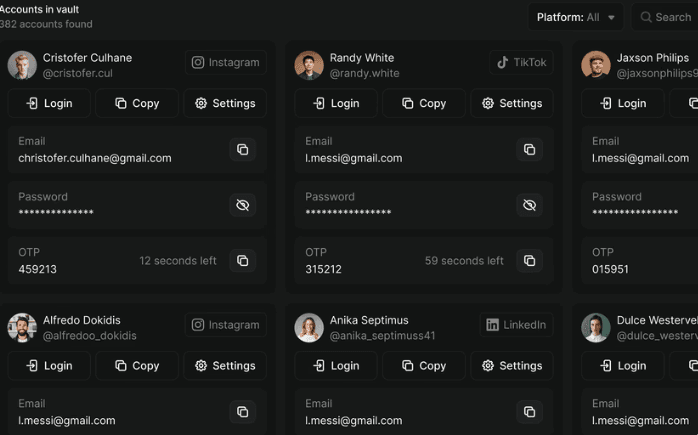

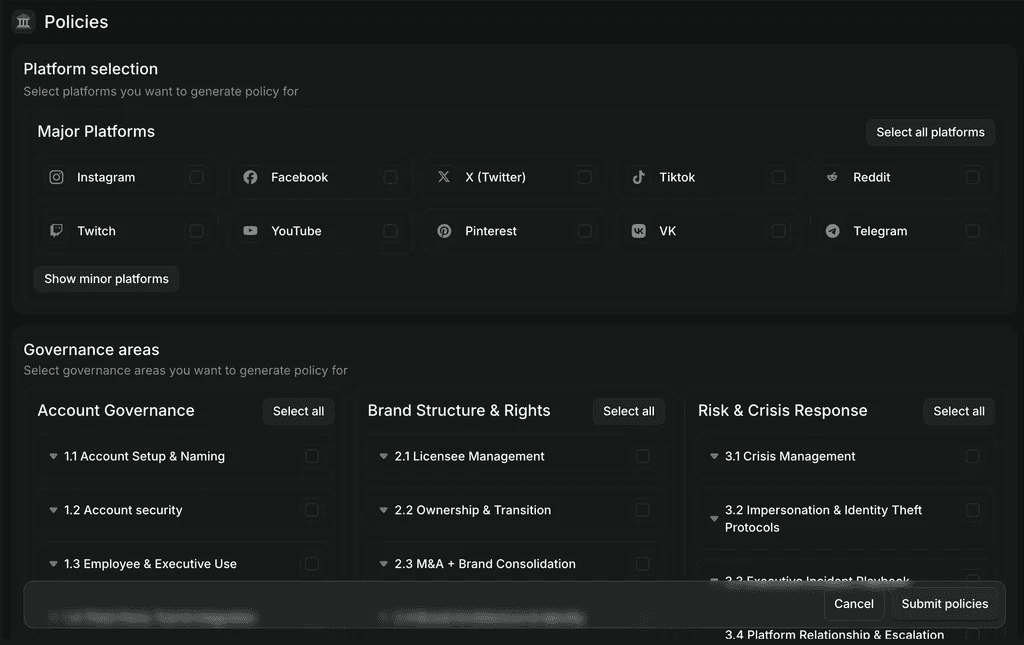

Tools like Social Media Access Management Risks with Handles can help ensure that verified and credentialed accounts maintain secure ownership, reducing the chance of scammers taking control or misusing verified profiles.

Confirm Identity and Presence

Go beyond usernames and profile pictures. Check whether the expert has:

A professional website

Verified social profiles

Consistent branding across platforms

Articles, speaking engagements, or reputable media mentions

Duplicate accounts, inconsistent branding, or missing identity details commonly signal fraudulent behavior.

Solutions like Social Media Impersonation with Handles and Social Media Account Takeovers with Handles are designed to detect impersonators and prevent unauthorized access to legitimate accounts, two common methods scammers use to appear credible.

Evaluate Engagement and Community Feedback

Don’t rely solely on follower count. Instead, evaluate:

How they respond to questions

Whether comments reflect successful outcomes or complaints

Whether engagement seems organic or filled with bots

If users report losses, manipulation, or unresponsiveness after asking for proof, proceed with caution.

If engagement becomes misleading or harmful at scale, solutions such as Social Media Crisis with Handles help track emerging threats and reputational risks.

Cross-Verify Advice

Before taking action, especially with financial decisions, verify whether the advice is supported by:

Published research

Reputable news sources

Recognized institutions

Independent analysis

Be wary of advice that promises guaranteed returns, secret loopholes, or claims unsupported by external evidence.

Leverage Tools to Monitor Risk

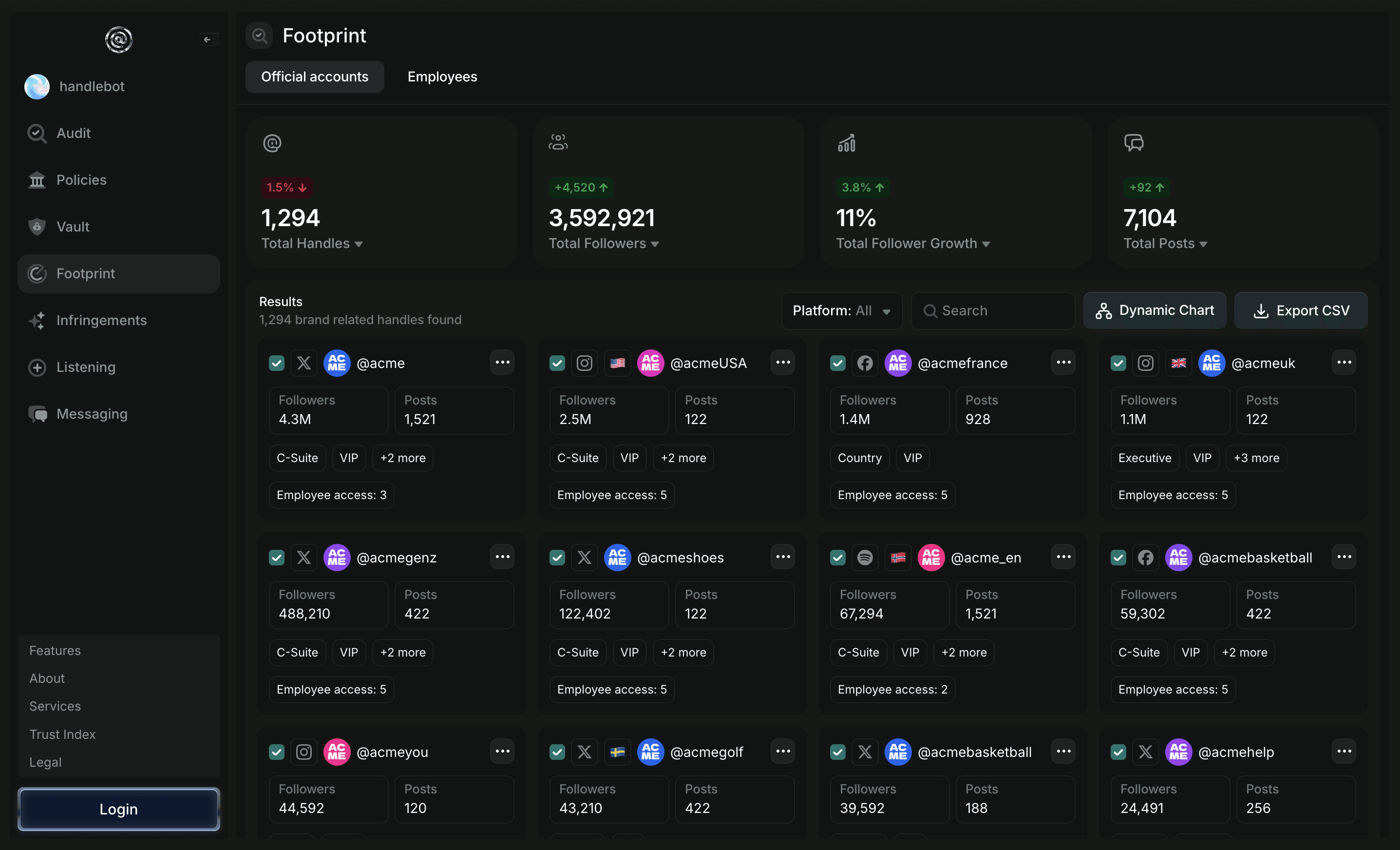

Technology can help validate authenticity and reduce exposure to fake accounts. Tools like Handles Radar and Audit monitor suspicious activity, flag impersonators, and help you determine whether an account is trustworthy or displaying unusual behavior.

How to Protect Yourself and Your Money

Protect Your Personal Information

Never share sensitive financial data, login credentials, or account details with anyone online, even if they claim to be a trusted advisor. Scammers often use direct messages or private groups to harvest information. Treat every unsolicited request with caution.

Use Strong Security Practices

Enable two-factor authentication (2FA) on all accounts, particularly those linked to financial services. Update your passwords regularly and avoid reusing them across multiple platforms. Security measures like these create a first line of defense against account takeovers.

Report Suspicious Accounts

Social platforms provide tools to report impersonators, fake accounts, or misleading financial advice. Prompt reporting can prevent scammers from reaching more users and help protect the wider online community.

Follow Verified Sources

Engage with financial advice from official accounts of banks, investment firms, and regulatory bodies. Verified profiles and official websites reduce the likelihood of interacting with fraudulent actors.

Educate Yourself and Others

Stay informed about common scams, emerging threats, and new fraud tactics. Share this knowledge with friends and family to create a network of informed users who can spot potential scams quickly.

Take Control of Your Online Financial Safety

Fraudulent financial advice on social media is everywhere, but with the right awareness and habits, you can protect yourself and your money.

By spotting red flags, verifying credentials, and taking proactive security measures, you reduce your risk and engage only with credible experts. While platforms are improving safeguards, personal vigilance is still the strongest defense.

For an extra layer of protection, not just for yourself but for your brand or digital identity, join Handles’ beta program. Get early access to AI-powered tools that monitor social accounts, detect impersonators, and secure your online presence

Apply for Handles Beta Today and take the first step toward smarter, safer social media engagement.

How it works

How it works

Learn details about

how we work

How it works

A case study

How we improved

Framer's life

adidas eliminated 9,000+ impersonator accounts and 241 high-risk threats

How it works

Chat with our team

Learn details about

how we work

How it works

Handles scanned in

the last 24h

Flag 9,000+ unauthorized accounts

Recover @adidasmotorsport in 24 hours

Remove 241 impersonators in 24 hours